Half of all children ages 0 – 8 in Tennessee live in households with incomes below 200% of the federal poverty level — that’s $51,853 annually for a family of two adults and two children. The United Ways of Tennessee ALICE report (Asset Limited, Income Constrained, Employed) says a survival budget is $65,040 for that family of four, and also that pre-COVID, 47% of Tennessee households reported being 1 emergency away from financial ruin. The impact of COVID-19 will have only worsened these statistics.

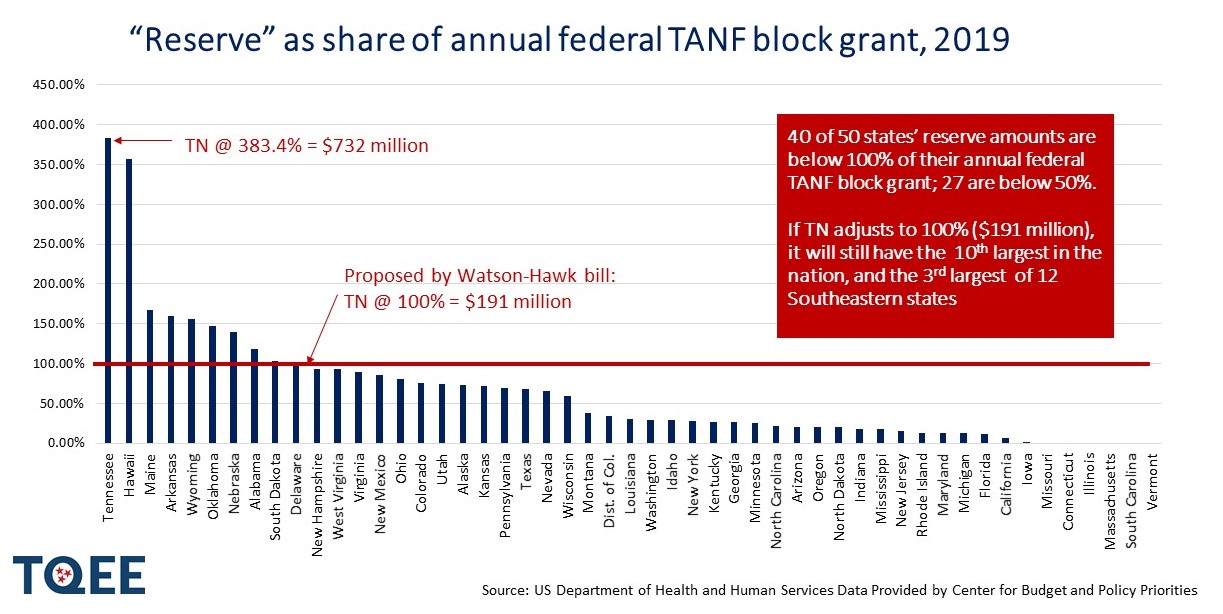

Meanwhile, at $732+ million, Tennessee has amassed the largest in the nation reserve of federal Temporary Assistance for Needy Families (TANF) funds, a result of the state regularly spending less than half of its annual federal TANF block grant of $191 million.

Last year, a joint legislative TANF working group, appointed by Lt. Governor McNally and Speaker Sexton, met to study how Tennessee had amassed such a reserve and how the TANF funds might be better managed. One of the items they considered is what reserve amount would be appropriate, and they consulted the state Comptroller for guidance. The Comptroller conducted research and reported there are no best practices or formulas for a reserve, and that the reserve amount would depend on the vision the legislature has for the TANF program. The Comptroller also suggested looking at TANF reserve policies of other states in the Southeast as a frame of reference.

The Watson-Hawk proposed Tennessee Opportunity Act acknowledges the importance of maintaining a reserve while also deploying these much needed resources to mitigate the adverse effects of child poverty and give working families a leg-up to overcome economic hardship. The bill reasonably and conservatively proposes establishing a reserve equal to a full year’s annual federal TANF block grant — $191 million.

By comparison, the state’s two big reserve funds — the rainy day fund and the TennCare reserve fund — which according to the Sycamore Institute would combined cover about 33 days of state-funded General Fund operations. In view of that data, 365 days of TANF reserve is quite conservative especially since in recent years we’ve been spending less than half our annual block grant.

And it’s important to remember that the TANF reserve doesn’t sit on Tennessee’s books or in an account generating earnings –and it can’t be returned to taxpayers. The TANF reserve is really just a “capacity” that we have to draw down reimbursement funds from the federal government.

So assuming the reserve is set at $191 mill, Tennessee’s ranking would go from #1 highest in the nation, to a still very conservative 10th highest in the nation according to the latest available (2019) data. TN’s state ranking for $191 million might be even higher when we see 2020/21 data, as it’s likely that during the pandemic other states with surpluses drew them down while Tennessee did not. In fact, at a November 2020 budget hearing then Commissioner Barnes reported Tennessee’s reserve had actually risen from the $732 million in 2019 to a new high of $741 million.

The bill also importantly addresses the ’til now unanswered question of the purpose of a reserve, stipulating that the reserve could be tapped “to address any emergency that has been declared in the state or to address economic needs arising when the state unemployment rate reaches a level deemed concerning by the governor”.

We applaud Senator Watson and Representative Hawk — both members of the joint TANF working group –for their leadership on this bill. We agree that the proposed reserve is appropriate and reflects the fiscal conservatism of Tennessee government, and we strongly encourage the passage of this important legislation.

You might also be interested in: Serve & Return: How Child Development Starts at Home